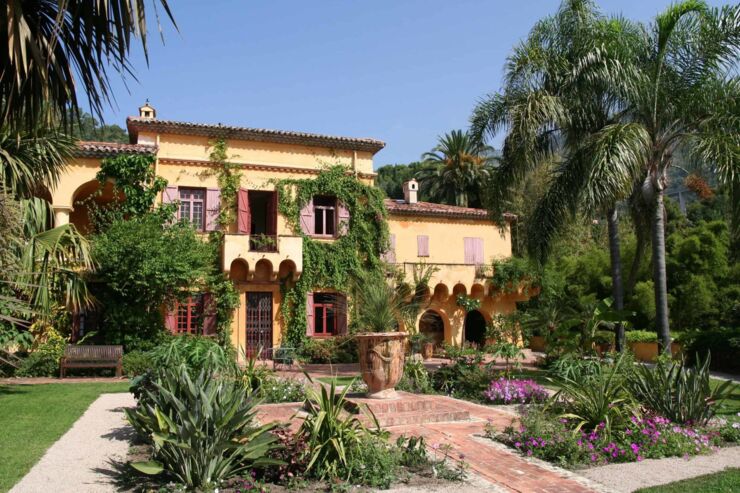

Through one of our trusted introducers, I was recently introduced to a client wishing to release equity from a holiday home in a highly desirable area of Marbella. My client was a partner within a large management consultancy and had a very distinguished record within his industry.My client wished to acquire a bridging loan through equity release on his holiday property via an SPV which was based in Gibraltar. The property itself was a four-bedroom villa equipped with a swimming pool and other luxury accessories, valued at €600,000. My client required €400,000 for his equity release, around 66% loan to value (LTV).

Initially, there were two causes for concern with this case: Firstly, borrowing through a foreign based SPV can conjure a raft of issues which are not present when borrowing directly and secondly the valuations process in Spain can often be unreliable, which can cause delays in Spanish mortgage process.

Spanish valuations are known to overvalue properties in question, so to avoid any difficulties here I contacted a trusted valuation partner of mine in Marbella to ensure an independent, realistic valuation. Fortunately, they were able to do this the next day and the original Spanish valuation was not wildly off the mark, allowing the process to continue unhindered and without delay.

As a point at Enness, we will always conduct a new valuation on properties in question to give peace of mind to both client and lender.

With regard to using the Gibraltarian SPV as a lending vehicle, my client’s situation was transparent and straightforward, meaningthe lender had no issues lending this way. Equity release in Europe is often harder than in Britain but fortunately, terms were offered very quickly.

This case is an example of the efficiency and rapidity with which we, at Enness, are able to process bridging loan enquiries. From the initial enquiry to completion, this case took around three weeks. For those looking for bridging finance, this is an excellent time-frame to work to. Bridging, by its nature is a short-term finance solution and it is only right that terms are offered as quickly as possible.

My client was offered the full amount, €400,000 at a very impressive rate of 0.8%. Needless to say, my client is ecstatic at the work we have done for him and looks forward to working closely with us in the future.

Information contained in our case studies is for market and illustrative purposes only. In some cases, these may be made up of multiple cases and are for illustrative purposes only.

Some case studies are made up of enquiries that have come into the business, not all business completes, and the posting of a case study does not represent a completed piece of business.