Caribbean Case Studies & Articles

Location: London, UK

Value: £400,000

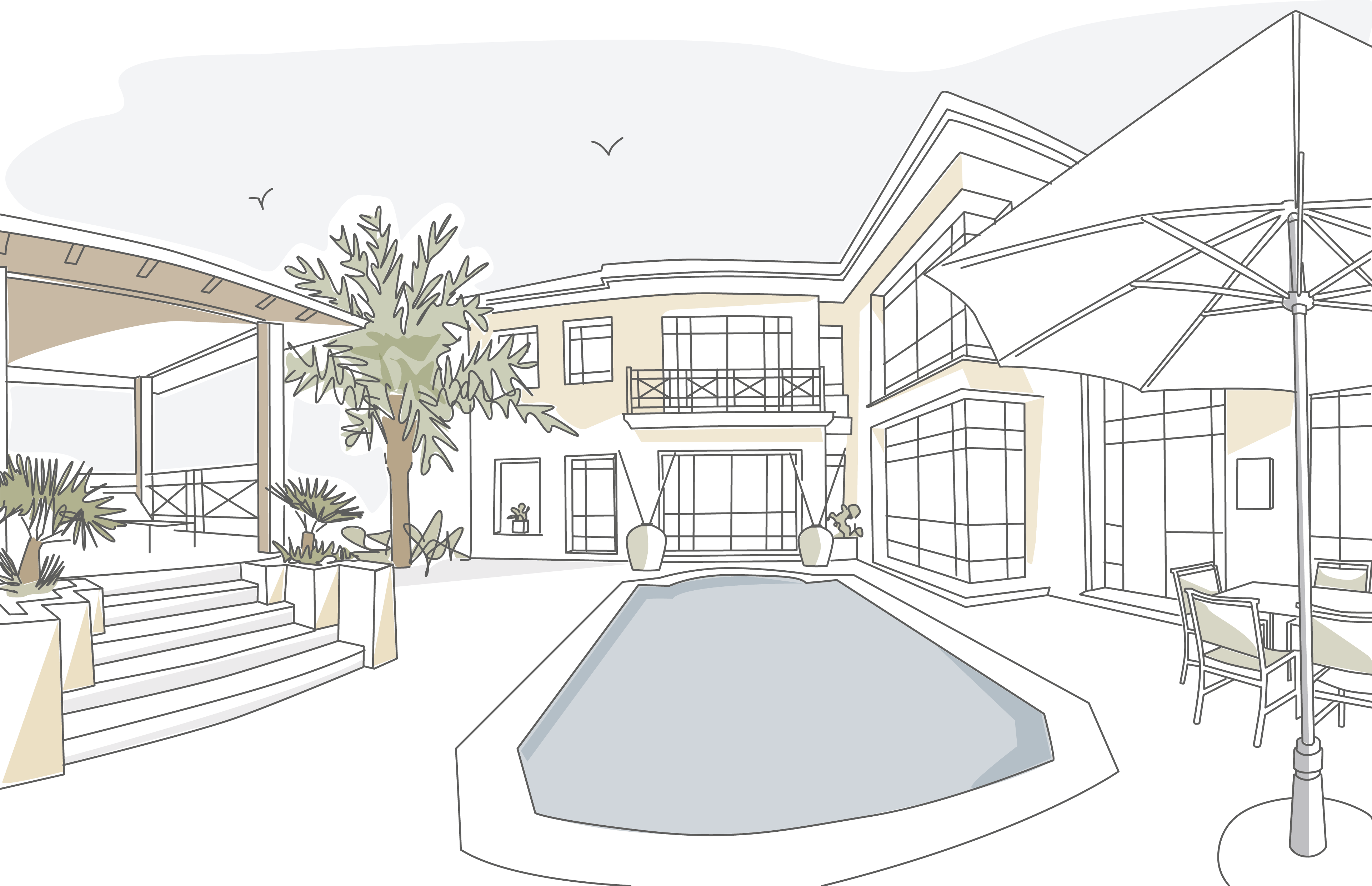

The Caribbean is one of the most sought-after locations in the world to buy property. The tropical climate, sandy beaches, excellent hospitality, and openness to foreign investment make the region particularly attractive. The variety of property on offer and the stunning locations to choose from also add allure for foreign investors: real estate in the Caribbean offers something for everyone.

500+

A large network of trusted lenders.

6

Global market locations.

15+

Years of experience.

Caribbean mortgage experts help you navigate local lending regulations and currency differences, securing the best terms for your property goals. Get in touch with us today to explore your options.

The Commonwealth of the Bahamas lies in the Atlantic Ocean off the southeast coast of Florida. The Bahamas is an archipelagic state which consists of more than 700 islands, cays and islets. The Bahamas mortgages industry has benefited from investment by non-residents who flock to the region to enjoy the beautiful scenery and the relaxed lifestyle.

Some of the more popular holiday destinations in the Bahamas include Atlantis Paradise Island, Nassau, Harbour Island, and Grand Bahama. The "best" place to buy property in the Bahamas will depend upon the type of property you are looking for – the country can cater to everything from luxury apartments to your own private island.

St. Barts is an overseas collectivity of France. French overseas collectivities are essentially French administrative regions. However, St. Barts and some other regions (French Polynesia, for example) have semi-autonomous status.

St. Barts lies in the French West Indies. Rather than being a single island, St. Barts also consists of several other small landmasses (all uninhabited) and several islets. The pristine white sand beaches, turquoise seas, warm but dry climate, and luscious greenery has long made St. Barts a magnet for high-net-worth individuals.

Despite its size, the island offers exceptional hotels, restaurants, shopping and leisure activities. As a result, the rich and famous are well known for holidaying on St. Barts, and many people love the location so much that they go on to acquire a vacation or second home on the island.

It’s also relatively easy to get to the island with regular flights from Europe and the US. Flights usually stop in neighbouring St. Maarten (just 15 minutes flight away) or Puerto Rico, depending on your carrier and where you’re coming from. St. Barts also has the necessary infrastructure to support private jets, and the harbour can easily berth superyachts.

There are few restrictions on who can buy property on St. Barts, regardless of whether you are interested in purchasing a property to live in permanently or part-time, or if you are in the market for a holiday home.

As in other havens for high-net-worth property investors, the only limitation on ownership is likely to be property price. St. Barts real estate is truly spectacular, and you’ll find everything from hillside villas to lateral waterfront living. The best properties tend to cost several million pounds. The entry point varies, but you can generally expect to pay more than £5 million for a property on the island. The best real estate can easily reach multiple tens of millions of pounds.

Even property on the lower end of the price scale in St. Barts is often genuinely exceptional. You can expect to find modern property finished to very high standards with sweeping sea views, a pool, multiple bedrooms, and ample outside space, which will sometimes include land.

The Bahamas government has been very keen to attract overseas investment for many years. As a consequence, the process of buying a house in the Bahamas is relatively straightforward. There are no restrictions on who can purchase property in The Bahamas, regardless of your nationality.

The size of the Bahamas means there is a variety of properties available. Waterfront villas, beachfront homes, property in luxury resorts and even apartments (usually in Nassau) are all on offer. Few other countries in the world offer the opportunity to purchase your own private island, but The Bahamas is one of those rare places where islands and cays can be bought freehold. Both undeveloped and developed islands are for sale in The Bahamas.

Real estate in The Bahamas is costly, and property starts at about £1 million for apartments in Nassau. Villas and luxury property cost significantly more, starting at around £2 million for modest villas. Larger property, homes with land and waterfront real estate will cost substantially more. Islands and cays vary significantly in price: very generally, prices start at around £8 million for an undeveloped island. Developed islands can easily set you back several tens of millions of pounds.

Whatever you are looking to buy, the Bahamas mortgage market is relatively liquid and can accommodate even the highest value real estate purchases.

Wherever you are buying in the Caribbean, you will want to ensure that your property finance is structured in a way that best reflects your financial situation and income. You will also benefit from Enness' ability to structure Caribbean mortgages in a way that considers taxation, mitigates exchange rate risk (St. Barts uses euros and the Bahamas US dollars), and ensures you are using the most advantageous legal structure for you.

Enness will ensure that your mortgage finance is streamlined, tax-efficient and complements the rest of your financial affairs.

Mortgages in the Bahamas tend to fall into two main categories. The first is typically mortgages that are relatively simple in terms of structure but for which you may need to borrow a significant amount from specialist lenders. Alternatively, you may have a highly complex situation that requires meticulous – and specialist – planning. The latter can range from borrowing a million dollars all the way up to a multi-million-dollar investment.

Whether you will need a more "traditional" mortgage or a very bespoke finance deal, Enness will be able to put together the best financing for you. Your broker will also have access to alternative lenders and will be able to open up the world of private equity, hedge fund, and family office funding which is not generally publicised but available to select individuals with the right situation and background.

Depending on your circumstances, Enness usually try to accommodate foreign real estate investment in the Bahamas via private banking relationships. Private banking services in the Bahamas are targeted to high-net-worth individuals with global assets and multiple income streams, different currencies, and personal backgrounds.

Bear in mind that you will need to bring at least some capital to the table for Bahamian mortgages: banks will want to see a degree of liquidity and an interest reserve account equal to one year’s interest on your mortgage. Outside of this, there is generally significant room for negotiation, however. As a result, Enness will be able to negotiate deals and terms that would be out of reach to you operating alone or with less experienced brokers.

These are generally the most flexible in terms of appreciating foreign income and worldwide assets. Enness will structure the perfect deal for you, present your financial situation in the best light, and secure the best mortgage finance.

Given St. Barts’ status as an overseas collectivity of France, many French lenders are active in the region when it comes to property finance. This is especially useful for Europe-based clients who may already have a relationship with a French or international bank. Like other islands in the region, the government of St. Barts is hugely encouraging of overseas investment, especially when it comes to real estate. As a consequence, non-residents should have no legal issues when looking to acquire property on St. Barts.

Regardless of your nationality or residence, there are very few restrictions for anyone looking to borrow against the real estate on St. Barts. That said, if you are a French national, you are likely to receive particularly favourable finance terms if you are looking to acquire property in the area due to the island’s close relationship with mainland France.

Traditional French banks and private banks tend to be the most common finance providers when looking to acquire property on St. Barts. While both capital repayment and interest only mortgages are available, interest only mortgages tend to be more accessible for liquid clients. Many private banks offering mortgages for St. Barts property will also require the initiation of a new private banking relationship and the placing of assets under management to get the most competitive finance.

Property in St. Barts is always in demand. The lifestyle, investment opportunities, climate, leisure activities, and favourable taxation environment have made St. Barts an extremely popular destination. This is unlikely to change any time soon. Finance is readily available through French lenders and international mortgage finance players also offer further choices.

St. Barts enjoys a privileged tax status which tends to attract high-net-worth individuals. Once you have been a resident on the island for more than five years, you will be exempt from income tax. You will also be exempt from VAT, wealth tax (on real estate held on the island), and any other type of taxation. If you are planning ahead, you’ll be interested to note that there is no inheritance tax liability for property held on St. Barts.

The Bahamas also has an attractive fiscal regime. Income, inheritance and wealth tax are not applicable to residents, and neither is corporate tax. There is, however, property tax on residential property, and you will need to understand what these levies will mean for you under the guidance of specialist advisors.

The Bahamas is a popular location for property investment. As well as holding property that increases in value over time, you may be interested in renting out your property for part of the year to generate income. If you wish to do so, it is worth noting you will require a rental licence as a foreign investor. There is also an annual tax charge for renting out properties:

When you consider that properties in the Bahamas regularly change hands for tens of millions of dollars, it is worth considering this annual tax charge if you are looking to rent out your property.

Enness have access to more than 500 lenders. Your broker will be able to negotiate the best deals for you. Enness also has relationships with specialist lenders who operate in St. Barts and The Bahamas, whether these are French players, private banks or niche alternative lenders. Your broker will also have all the private banking connections which can allow you the best deals for more complicated structures.

Your broker will look to maximise your lender’s recognition of your worldwide income and assets and create a unique mortgage finance structure the meets all the needs of your particular scenario. This maximises mortgage finance while minimising your long-term financial liabilities.

Give Enness a call for a no-obligation chat, and we can discuss your situation in more detail and potential solutions.

Arrange A Callback Now