Offset mortgages are relatively niche residential property finance products. While they haven't been popular (or readily available) in recent years, they have lately become attractive for wealthy borrowers to explore in the current economy. The primary reason for this is the rising interest rate environment. With such low interest rates over the past few years, high-net-worth individuals have tended to keep cash reserves in the form of savings relatively low, preferring to invest in higher ROI opportunities – stocks, businesses, projects, investments and so on. However, as the UK faces a recession, individuals want to keep liquidity and capital reserves more readily available, and savings accounts are again topping up.

As the markets – and with it the lending landscape – change in response to different economic and fiscal developments, different types of mortgage come onto the market as lenders look to entice borrowers to take up their products and as they react to clients' financial preferences and strategies. Offset mortgages are one such product.

What is an Offset Mortgage?

You may find that niche products like offset mortgages are more beneficial to you than a standard capital and interest mortgage in today's economy. They are especially beneficial if you are a high-net-worth individual that can – or will – put aside a significant amount of capital in a savings account.

An offset mortgage is linked to at least one savings account at the same lender you borrow from. Your lender will look at how much your mortgage is worth in terms of how much you have borrowed and the value of your savings. You'll pay interest on the difference between the two amounts rather than the whole amount you owe for your mortgage. Because of this, you will effectively be overpaying on your mortgage each month, which can reduce how long it will take you to pay off what you've borrowed.

You can't use the money you have in your savings account to pay off the mortgage – you will need additional income or liquidity to make your monthly repayments. However, you will use your savings to reduce what you will pay in interest. You should note that you will not earn interest on the savings account(s) linked to an offset mortgage because you are getting a different financial benefit from the product (i.e., reduced interest calculated exclusively against the offset amount). However, this can be fiscally beneficial as you will also not pay tax on the interest generated via your savings as you would usually.

Key Benefits of Offset Mortgages

As products, offset mortgages are beneficial because they:

- Can reduce the amount you will pay in interest. What you will save (i.e., the interest you are charged on the offset amount) will usually amount to a more significant net saving than what you would earn on interest on your savings alone

- Are fiscally advantageous. The savings you use to offset your mortgage won’t be eligible for interest. The fact that you won’t earn interest, however, means that you won’t have a fiscal liability on this amount

- Allow more flexibility than a standard capital and interest mortgage. You can choose to keep repayments low and keep the mortgage for longer or make larger repayments to pay off the mortgage faster and reduce your interest rate

- Can sometimes be linked to multiple savings accounts, decreasing the offset amount. This is ideal if you have different savings accounts – if you have various income streams which go into separate savings accounts, savings accounts in multiple currencies and so on

- Sometimes allow you to use your offset mortgage like a floating facility, drawing down and paying off the balance as you like without incurring penalties. You retain liquidity and can use offset mortgages to respond to opportunities quickly, as you will have capital readily available, while still benefitting from beneficial rates even if you don’t draw down any capital from your savings

- Are increasingly competitive. Several lenders have re-entered offset mortgages into their product suite or are actively marketing offset mortgages. As a result, they are looking to win business by offering ambitious rates versus other lenders

- Are ideal for high-net-worth individuals. Because offset mortgages are most beneficial for borrowers with large savings accounts, lenders tend to optimise them for the top of the market – also as a strategy to reduce risk. As a result, many are interest-only products which are ideal for wealthy individuals

Offset Mortgages: What’s on Offer?

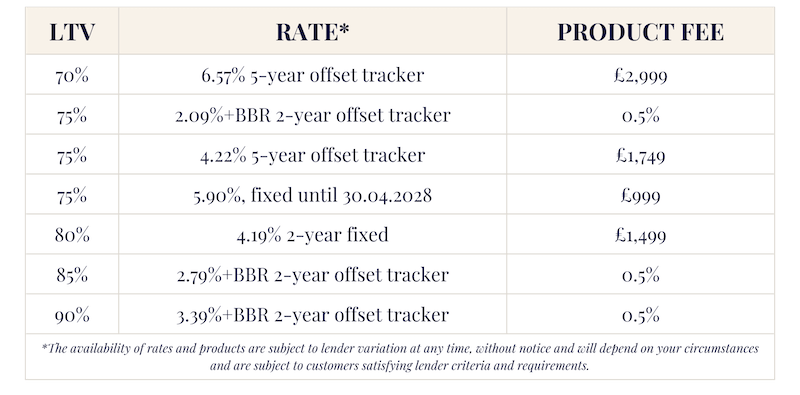

As with more conventional mortgage products, fixed and variable rates are available for offset mortgages. Some borrowers will prefer fixed rates in the current interest rate rising environment, given they provide clarity on what borrowing will cost. Others prefer tracker rates (which follow the Bank of England Base Rate) as they can be more competitive. Ultimately, fixed and tracker rates offer potential advantages and drawbacks – one isn’t ‘better’ than the other. As long as you understand the benefits and potential pitfalls of each type of product and receive personalised advice when you take out your mortgage, both can be equally advantageous. When choosing fixed or variable rates, it's essential that you make an informed decision based on your financial situation, understanding all the facts.

Additional Opportunities of Offset Mortgages

Offset mortgages are especially beneficial for high-net-worth individuals with significant savings and a good deposit they can put forward for a mortgage. Large offset mortgages are available – multi-million-pound offset mortgages are increasingly common, for example. Offset mortgages tend to be most readily available as of 80% LTV (although for very high-net-worth borrowers, there is some flexibility with 90% LTV a possibility). However, the more you put down as a deposit, the more competitive the interest rate will tend to be, in addition to the benefits the offset provides. It is worth running calculations and working out what LTV will get you the best rate if you have significant liquidity to divide between savings accounts (i.e., creating the offset base) and your deposit. We can run these simulations for you.

Family offset mortgages are, again, niche options but are also possible, offering several advantages. In these cases, parents (or sometimes grandparents') savings can be used to offset a mortgage linked to a property bought for a child or grandchild – again, this tends to be ideal for high-net-worth individuals and families.

The key benefit here is that family members can help children buy a property and reduce the interest a child or grandchild will pay on their mortgage. The product allows them to do so without directly gifting the family member a significant sum of money which can have fiscal implications. At the same time, the 'owner' of the savings account – mum, dad, grandma or grandpa – retains control of their savings and the ability to help out more if they want to. In many ways, family offset mortgages are ideal because they set a precedent of shared responsibility without being too involved in making monthly payments on behalf of the recipient, which can be beneficial for all involved. The downside of this arrangement is that if the person whose savings account is linked to the mortgage wants to use some of that capital, the family member can incur larger monthly payments as the offset is more significant. How you plan to use your savings needs to be carefully planned in these cases, and family offset mortgages tend to be an ideal scenario if you don't plan on drawing on your savings.

Offset Mortgages: What to Bear in Mind

You will need to assess if an offset mortgage is financially beneficial. You’ll usually need to do this by looking at personalised simulations and comparing different mortgage products. You’ll also need to consider if you want to pay back a minimum amount, make larger monthly payments or if you plan to take out savings during the mortgage term. You won’t generate any interest on your savings over the course of the mortgage (but also won’t incur tax on the amount). However, you may find that an offset mortgage is cheaper than a capital and interest mortgage. That said, you will need to crunch numbers to determine the difference and whether it’s a nominal or significant saving, which is very challenging to do yourself as you aren’t comparing like-for-like products or borrowing scenarios. You will also want to understand how your repayments will affect the mortgage term: larger repayments will see the loan term (and interest due) reduce, and paying less will see the mortgage last longer and incur more interest. There will be reasons for doing both depending on your requirements, but it will pay to understand the benefits and your strategy. We can run a cost analysis that will allow you to understand what is most financially beneficial for you, what will save you the most, and how deviating from your original plan might affect your payments and term.

You’ll usually be able to use your savings during the mortgage term, freeing up liquidity and paying more interest on the basis that you have a larger offset ‘gap.’ Lenders are open to this, especially at the top of the market for quality borrowers with a significant asset base that brings comfort. However, it is worth discussing your plans with a broker upfront, especially if you believe you might want to take out a significant amount of your savings. The ability to draw down significant amounts from your savings will impact what interest rate you pay – in some cases, quite substantially – so factoring costs is essential. Lenders may also restrict how much you can draw down from savings, and it may be beneficial that we negotiate terms or flexibility upfront, depending on your needs or why you may want to draw down capital.

Because you will use your savings as part of the offset mortgage package, you won’t be able to use this amount to put towards a deposit, so you will need to have significant capital available to make this type of mortgage worthwhile. In other words, you will need to have cash (usually at least 20% but sometimes more) to put forward for a deposit in addition to a significant savings base – offset mortgages don’t allow for an ‘either or’ scenario. Again, this underlines why these products are especially beneficial to liquid and high-net-worth individuals with large savings accounts and good liquidity to put forward as a deposit.

This guide is for information and illustrative purposes only and nothing contained within should be construed as advice or a recommendation. Where we have quoted loan to values, rates and fees, the actual products available are subject to lender variation at any time, without notice. Availability will also depend on your circumstances and satisfying lender requirements. Mortgage debt is secured on your home. Your home may be repossessed if you do not keep up repayments on your mortgage or other debts secured on it.

Market analyses reflect the personal views of the authors and do not necessarily represent the views or opinions of Enness. All comments are made in good faith and we do not accept liability for them.

For more information or to discuss this further please contact our Relationship Management team on 0203 758 9393 or email us on [email protected]’