GCC resident demand for super-prime property in Europe remains strong, driven by the enduring allure of high-end European real estate, the climate, amenities, quality of life across the continent, relatively few restrictions for foreign investors owning property and availability of finance.

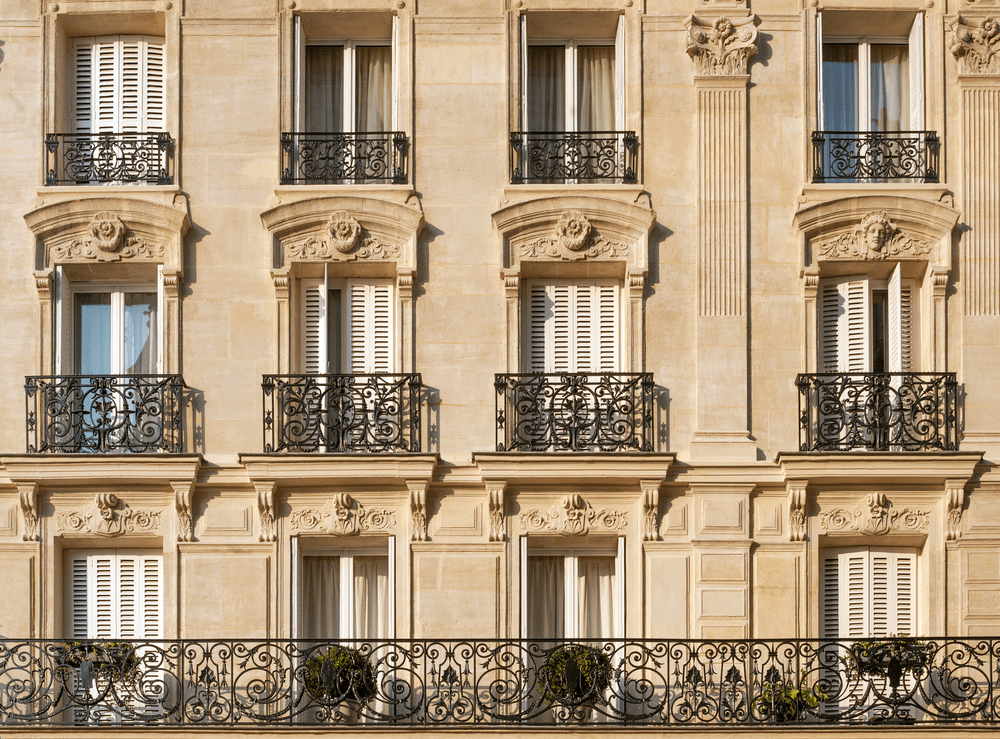

When it comes to super-prime property on the continent, there is something for every type of Middle Eastern buyer, from buy-to-let investments to holiday property and trophy homes. Italy is known for its palatial Italian villas on the lakes, Paris offers Haussmanian apartments and classic 'hôtel particular,' the Cote d'Azur has stunning villas, London delivers superb townhouses and mansions, and the UK's country estates remain sought-after. The Swiss and French Alps, Spain and Portugal also offer incredible real estate in high demand from foreign investors, GCC residents included.

Private Bank Mortgages

If you want to purchase prime European property, private banks tend to be the best providers of high-value mortgages in Europe for several reasons, which include:

- Offering a completely tailored mortgage that meets your financing needs and also considers structuring, repayment, consideration of your global net worth to assess affordability and suitability for certain types of products, unregulated lending (usually when you are a high-net-worth individual that meets specific criteria with regards to income and global assets/net worth), etc. It is worth noting that to benefit from these features, a European mortgage from a private bank will still need to be negotiated to access the most competitive deals

- An understanding and ability to cater to high-net-worth individuals' requirements for high-value European mortgages when it comes to fiscal optimisation, risk management, privacy and succession planning, including purchasing and borrowing via corporate entities

- A range of European mortgage products optimised for high-net-worth individuals (including high loan-to-value mortgages, £10 million+ mortgages, interest-only mortgages, 100% mortgages when assets are placed under management, etc.)

- An ability to understand and consider income from the Gulf region, which can be different to the standard in Europe (large gifts, income derived from trusts or corporate structures, multicurrency income, income derived from businesses, relatively low income compared to a very significant net worth, etc.) Domestic retail banks often struggle to be able to offer mortgages in cases where there is any 'non-standard' income, especially in high-value borrowing scenarios

- Sharia-compliant mortgages from banks with links to the Gulf region and the UK and Europe

Understand Where - And What - You Can Finance In Europe

While there can be legal limitations on where you can buy property in Europe (Switzerland only allows foreign nationals to purchase property in some parts of the country designated 'holiday zones', for example), Europe has largely unrestrictive laws on foreign property investment. However, when it comes to high-value mortgages for prime property purchases, it's only possible to finance some types of property in some parts of Europe. Simply put, there are limitations on what property a private bank will collateralise a mortgage against.

Get in the Know

Subscribe to our newsletter

Property investors from the Gulf region tend to buy luxury property in Europe's most popular and glamorous regions, facilitating financing and mortgages. However, there are some caveats on the 'where' and the 'what'. Private banks will, generally, only offer mortgages for property in 'prime Europe' rather than anywhere on the continent. Prime Europe roughly translates to the most popular, recognised and sought-after areas, where the property market is most liquid and there is near-constant demand for prime real estate.

The following list is not exhaustive but widely lays out where it is possible to finance prime European property if you hail from the Gulf:

United Kingdom

- London residential real estate, including very high-value properties in central London

- Country estates

- Prime property outside London, including in rural areas or smaller towns

France

- Cote d’Azur region (including some communities set back slightly further back from the coast such as Eze and La Condamine)

- Prime central Paris and select properties in prime enclaves such as Neuilly-sur-Seine and St-Cloud

- Up-market ski resorts in the French Alps (Courchevel, Val d’Isere, Megeve, Meribel)

Italy

- The Italian lakes region, predominantly villas on Lake Como and Italian Lake Maggiore

- Some prime properties in central Milan and Rome

Switzerland

- The most famous/popular ski resorts in designated holiday zones where non-residents are permitted to buy property (including Verbier, Gstaad, and St Moritz)

Portugal

- The Algarve

- Quinta Del Lago

Spain

- Costa del Sol

- Balearic Islands

Monaco

- Any property in Monaco is usually relatively easy to finance if your financial background supports it, given the size of the Principality and density of housing, the exclusiveness of the jurisdiction and the barriers to entry in terms of property prices

While there is plenty of high-value real estate throughout Europe - including large or classical properties, it will be challenging to get a European mortgage on any real estate not in a prime location, regardless of value.

It is also worth noting that getting a mortgage on historical properties outside of prime regions is challenging, especially if it requires renovation work, given lenders are increasingly shying away from financing these properties in all but the most exceptional cases. France, for example, has many beautiful chateaux in remote regions which can be considered 'bargains' compared to more popular prime markets (Italian palazzos and villas in more remote areas mirror this); however, by and large, private banks will not consider financing this type of real estate, regardless of the quality and net-worth of the borrower.

The exception in Europe is the UK, where financing is far more available regardless of property type, given the number of lenders, property market and demand for prime property from domestic and international investors. Historical real estate (castles, stately homes, central London property in need of complete refurbishment or conversion from commercial to residential real estate, rural or remote country estates) can all be financed with relative ease. In contrast, a continental European equivalent usually cannot.

High-value mortgages for prime property in Europe's most desirable locations remain easy to access through a broker, and significant mortgages of several million pounds or euros are available.

Assets Under Management

Placing assets under management (AUM) is increasingly a prerequisite of ultra-high-value mortgages offered by private banks to manage risk and engage in mutually beneficial client/bank relationships. Some UK private banks provide mortgages to GCC residents without assets under management, but interest rates are often higher than they would be placing AUM. However, placing AUM is usually a base requirement for continental European mortgages. Very few - if any - private banks offer even smaller European mortgages (€1 million) without a borrower being required to pledge funds with the institution.

It is worth noting that by placing assets under management, you will usually benefit from several advantages, including that you will typically be able to access a 100% loan-to-value mortgage. Your funds will also be managed in many cases, with returns covering the cost of the mortgage.

Sharia-Compliant European Mortgages

There are plenty of options for those wishing to have a Sharia-compliant European mortgage, particularly in the UK and France, which tend to be the most popular countries for GCC residents to purchase ultra-high-value property. The lenders that offer these mortgages tend to be banks with links to the Middle East that have outposts in London, France or another EU jurisdiction from which they can offer these lending products, which are generally as competitively priced as non-Sharia equivalents.

There can be more choices of Sharia-compliant mortgages in the UK than in Continental Europe, given the UK's position as a leading financial centre with strong links to the Gulf region.

Buying Property Without A EU or UK Credit Footprint

The lenders that offer prime European mortgages generally do not require you to have a European credit footprint. While a European credit history can make financing marginally easier, it is not a prerequisite for accessing a mortgage, particularly from a private bank, given they will look at your global financial position and net worth. Domestic retail lenders can struggle to offer mortgages to foreign investors with no credit footprint in the UK or EU, but a private bank will not require this.

How To Complete Property Transactions In Time For Summer

The European property market heats up ahead of the summer when many individuals decide to take the plunge and purchase luxury holiday homes. This means competition is higher, and cash buyers that can complete transactions quickly have an advantage. However, buying in cash isn't always ideal from a fiscal perspective because you won't have the capital available to you or because you don't want to dispose of other assets to create the liquidity you need. And while European mortgages can be relatively quick to arrange, they still take two to three months to complete at a minimum, especially if you are a foreign investor, as underwriting and compliance or regulatory checks can take longer to arrange.

Bridging finance is one way to purchase property quickly so that you can benefit from it this summer already. A short-term loan secured against residential real estate, bridging finance typically takes just a few weeks to complete, meaning you can take ownership of the property in the same timeframe. Very high-value bridging loans (£10 million plus) are available, and the amount you borrow will not lengthen the process: a 'small' bridging loan can be completed just as quickly as a large one.

When nationals from the GCC region purchase European property, bridging finance is usually unregulated and structured through corporate entities, facilitating ownership and ensuring maximum privacy. The loan is usually exited via a conventional European mortgage that's arranged either simultaneously with the negotiation of the bridging loan (to keep the term to a minimum, given bridging loans can be marginally more expensive than conventional mortgages) or over the course of the loan (around three years at maximum) allowing for time to source and negotiate the very best European mortgage while still being able to make use of your property.