Related Blog Posts

See Our Blog

The dollar is strong, and the pound is sliding as the UK battles inflation, mini-budget announcements, revolving Chancellors, a fractious Conservative party, Brexit and a potential energy crisis.

Much has been made in the press of the dollar's strength compared to the pound. The exchange rate alone dictates that there are opportunities for anyone with wealth in US dollars looking to buy prime property in the UK. But 'good savings' isn't enough to make calculated investment decisions, especially when we're talking about purchasing a multi-million dollar investment property. Understanding the potential for concrete savings, balancing the exchange rate with the rise in interest rates and when to go in – and come out – of a property investment is key to USD buyers maximising their returns and saving as much as possible.

We've analysed the potential savings and where the ROI will be for anyone with significant wealth in USD to buy prime UK property as an investment in the current market.

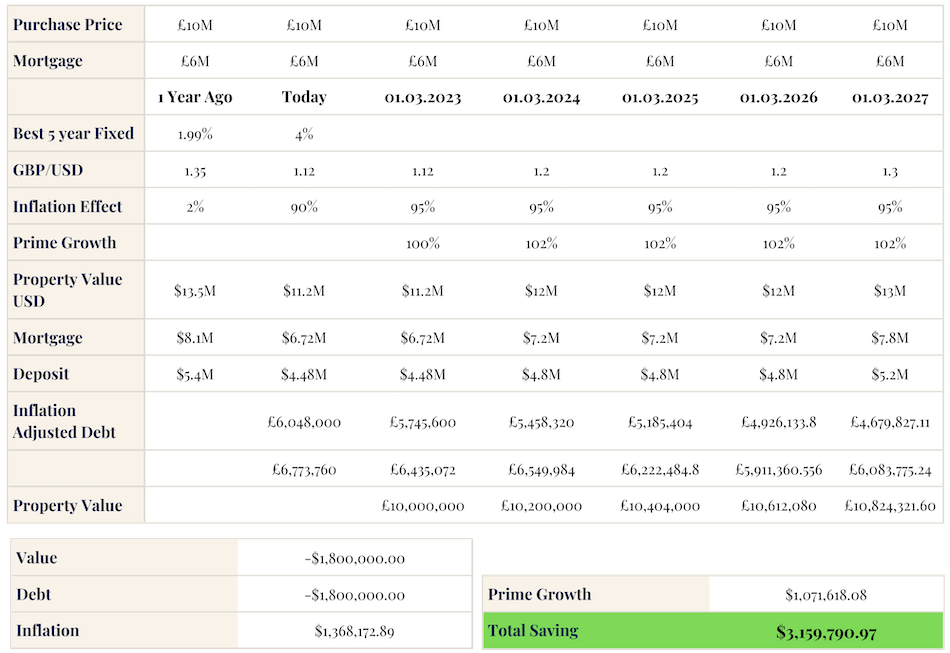

A £10 million property will cost US dollar buyers $11.2 million at today's exchange rate. That same property would have cost $13.5 million a year ago, so buying today is an immediate and concrete saving of $2.2 million down to the currency exchange alone. We believe that exchange rates will stay at around the current rates into next year, but that GBP will gain strength over time – rising steadily back to normal levels by 2027. This gives dollar buyers a relatively short window of time to buy a prime investment property and benefit from the current low exchange rate.

Taking out a mortgage means you will need to put down a deposit – 100% mortgages are few and far between in today's market. There's a saving to be had here, too. To determine the concrete cost impact for this, we took 5-year fixed rates on the basis of 60% LTV, with our hypothetical buyer putting down a cash deposit of 40%. That 40% cash deposit would have been $5.4 million a year ago. Today, that same 40% deposit amounts to $4.8 million.

Paying off a UK mortgage in USD also allows for substantial savings for USD buyers, who will benefit from the strength of the dollar against the pound as they make monthly repayments. The saving will amount to more than $1 million over the five-year period.

However, there is a caveat: USD buyers can only benefit from this saving if the property isn't let out. If the property is rented, the UK rental income will cover the mortgage in sterling. As a result, they won't benefit from the exchange rate in the same way as if they just held the property as an investment and paid off the mortgage in US dollars. Instead, buyers will benefit exclusively from the current low exchange rate to buy the property, the lower deposit needed in USD and the ROI generated by the appreciation of the asset at term if it is then sold.

Property prices play a key role in understanding what you can make in returns in the long term. There has been plenty of speculation in the market about UK property prices cooling, but to double your money, you need to get in – and out – of the market at the right time.

We believe that prime UK property prices will continue to increase in the UK, albeit at a slower pace than in recent years, potentially stalling for 18 months and then growing at a rate of 2% per year from 2024 onwards. We believe that a £10 million property you can buy today ($11.2 million at today's exchange rate) will be worth £10.8 million by Q4 2027. Assuming the pound will have risen against the dollar by then, we expect the property to be worth $13 million, a potential profit of $1.8 million.

The UK's high inflation rate will also benefit dollar buyers. While currency, debt and the property's valuation will provide concrete savings, inflation only provides a nominal benefit: rising inflation reduces the value of the debt you hold and can be considered a saving. However, that won't translate to cash in your pocket for buyers.

Buying a property today with a £6 million mortgage will see US dollar buyers take on £6.048 million in inflation-adjusted debt at today's inflation. Assuming inflation remains high over the next five years at more than 9% (which we believe to be likely), and the mortgage is worth $7.8 million in 2027, buyers stand to make a nominal saving of more than $1.3 million when we consider the inflationary impact on sterling over the period the property was held.